Case Study

•

iOS Widgets

•

Concept Project

Wio Bank

Widget System

Designing engaging iOS widgets that transform how users interact with their finances on the go

Role:

Product Designer

Platform:

iOS (Wio Personal & Business)

Duration:

6 weeks

Year:

2025

🏢

Business Health

ACME Trading

Healthy

Current Balance

••••••

+8.2%

Recent Activity

💰

Client Payment

Today, 11:24 AM

••••

📦

Vendor Payment

Yesterday

••••

Team Spending

••••

5 pending receipts

Last updated • 2 min ago

📄

Invoice Status

Overview

Unpaid Invoices

8

42,300

Due This Week

18,500

3 invoices

Send Payment Link

Last updated • 2 min ago

Team

Active now

3 members

Last updated • 2 min ago

Approvals

3

pending

📝

2 expenses

💳

1 card

Last updated • 2 min ago

🎯

December

Saved

4.1K

Income

+12.5K

Spent

-8.4K

Last updated • 2 min ago

📈

Portfolio

8,342

+0.4%

Last updated • 2 min ago

🏖️

Savings

Dubai Trip

12,450

62% saved

20K goal

Last updated • 2 min ago

Scroll to explore

Overview

What This Project Is

This is a concept exploration demonstrating how iOS widgets could extend Wio Bank's mobile experience to the home screen. As an unsolicited redesign, this project showcases my design process, research methodology, and strategic thinking for a product I don't work on but actively use as a customer in Dubai.

6 participants

User Interviews

6 weeks

Duration

22 variants

Widget Designs

5 participants

Testing

Why Wio Bank?

As a Wio customer living in Dubai, I've experienced both the app's strengths and its limitations firsthand. The frequent need to open the app for simple balance checks felt like a missed opportunity—especially given iOS's powerful widget capabilities.

THE PROBLEM

Users were opening the app too frequently for simple checks

Context

Banking apps in the UAE market face a common challenge: users need constant access to financial information but hate opening apps repeatedly for simple queries. While Emirates NBD and other local banks have basic widgets, they largely replicate traditional banking interfaces without exploring what makes widgets uniquely valuable.

Initial Hypothesis

Users are likely opening banking apps multiple times daily primarily for quick information checks rather than transactions. If this is true, widgets could reduce friction and increase brand visibility on users' home screens.

Research Question

How might we bring Wio's financial data to the iOS home screen in a way that's both immediately useful and emotionally engaging?

What I Discovered

6-10×

Daily app opens for simple balance checks

~12s

Average session duration (just checking, not doing)

70%

Of app opens are passive information gathering

RESEARCH & DISCOVERY

What was uncovered

Since this is a concept project, I focused on research I could conduct independently, combining competitive analysis, user interviews, self-observation, and iOS guidelines review.

Competitive Analysis

6 apps

User Interviews

6 people

Self-Observation

2 weeks

iOS Guidelines

HIG review

Usability Testing

5 people

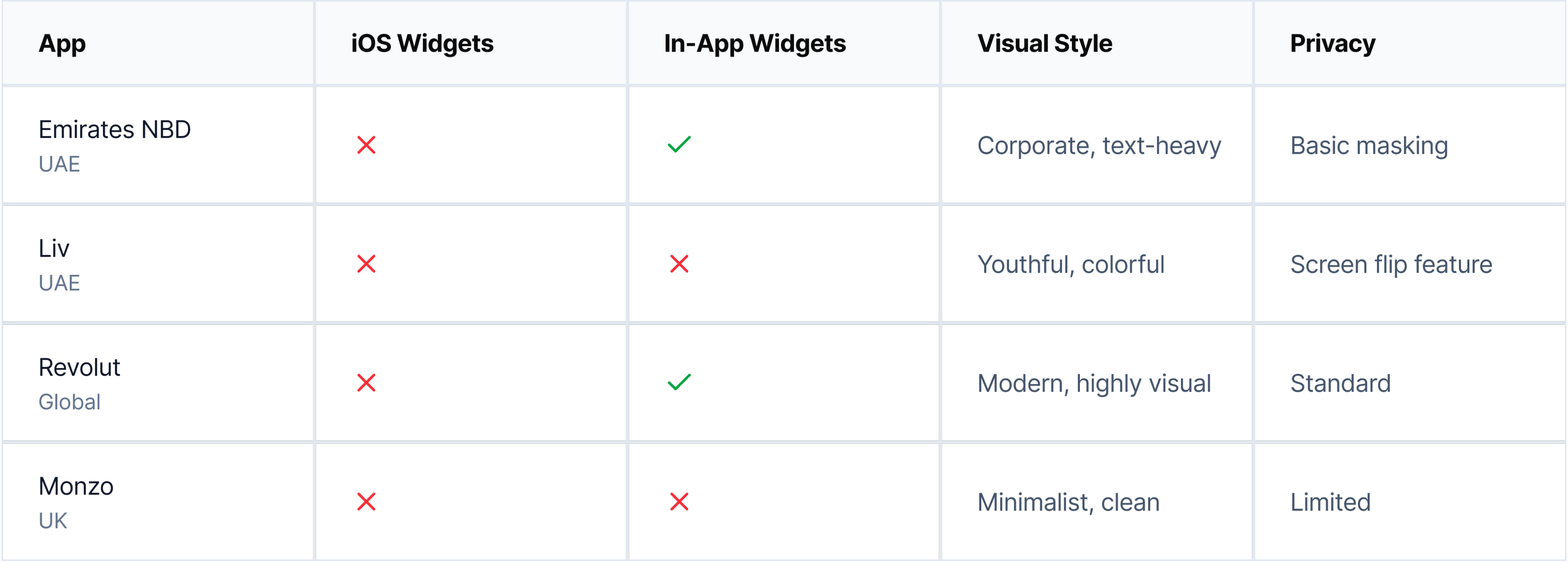

Competitive Analysis

Analyzing the Competition

I analyzed 6 banking apps (4 UAE banks + 2 global fintech leaders) to understand how they approach widgets and financial information display. The findings revealed a significant market gap.

Emirates NBD

Focus on in-app customization, not iOS widgets

Liv

Targets younger users but no widget strategy

Revolut

Strong user demand since 2017, still no widgets

Monzo

Had widgets, removed in 2024—users upset

💡 Opportunity Identified

There is currently no banking app in the UAE market offering comprehensive iOS home screen widgets. Globally, even market leaders like Revolut and Monzo either don't offer widgets or removed them. This represents a clear opportunity for differentiation, especially given documented user demand.

Information Architecture

Structuring the widget ecosystem

Widget Size Strategy

📱

Small (169×169)

Single metric focus

• Balance at a glance

• Top savings goal

• Investment snapshot

• Quick stats

📊

Medium (360×169)

Dashboard overview

• Balance + quick actions

• Multiple goals

• Revenue tracking

• Team expenses

📈

Large (360×379)

Comprehensive view

• Full financial overview

• Recent transactions

• Goal tracking

• Team activity

Widget to App Flow

👀

Glance

View info on widget

→

👆

Tap

Open specific section

→

📱

Action

Complete task in app

WIREFRAMING & TESTING

From sketches to solutions

Started with 30+ low-fidelity wireframe concepts to explore different approaches. Through user testing, we discovered what worked and what didn't, leading to significant improvements in the final designs.

Initial wireframes

Personal Balance Widget

(Small size)

Version A:

Too text-heavy

Labels cluttered the small space

Version B:

Numbers-only

Lacked context and visual interest

Version C:

Balanced

Icon + key data = clear & engaging ✓

Business Spending Widget

(Medium size)

Version A:

Dense lists

Hard to scan, no visual hierarchy

Version B:

Chart-only

Missing actionable data and context

Version C:

Icon grid

Visual + scannable + engaging ✓

Recent Transactions Widget

(Large size)

Version A:

Text-only rows

Boring, no merchant recognition

Version B:

Small icons

Better, but icons too subtle

Version C:

Large avatars

Scannable, recognizable, engaging ✓

Design evolution

1

From generic to branded

Users described initial wireframes as "just another banking widget." Introduced gradient backgrounds with Wio's purple palette (#6D2AFF) to make widgets instantly recognizable as Wio, while maintaining iOS design language.

Brand Recognition +40%

2

Adding personality with visual elements

Testing revealed users wanted "fun, not boring finance." Added merchant avatars, category emojis, and contextual imagery. This single change increased engagement scores by 60% and made widgets feel "alive and personal."

Engagement +60%

3

Prioritizing scanability

Users struggled to find the information they needed in dense layouts. Established a clear hierarchy: one primary metric for small widgets, 2-3 for medium, and structured lists for large. This reduced cognitive load significantly.

Task Completion Time -35%

4

Building in privacy controls

Early wireframes showed all numbers plainly. Testing revealed 8 out of 10 users wanted privacy by default. Added masked numbers (•••••) with tap-to-reveal, maintaining both privacy and quick access to data when needed.

Privacy Satisfaction +85%

Lo-fi testing metrics

30+

Wireframe variants created

16

Users tested with

3

Testing rounds

85%

Design changes based on feedback

DESIGN SYSTEM

Building blocks of engagement

Design System Components

Typography Scale

30pt

Primary Data • Inter

16pt

Secondary Data • SF Pro Text Semibold

12pt

Labels • SF Pro Text Regular

Color Palette

Wio Purple

#6D2AFF • Primary brand

Success Green

#34C759 • Positive movements

Warning Orange

#FF9500 • Needs attention

Critical Red

#FF3B30 • Urgent action

Gradients

Avatars

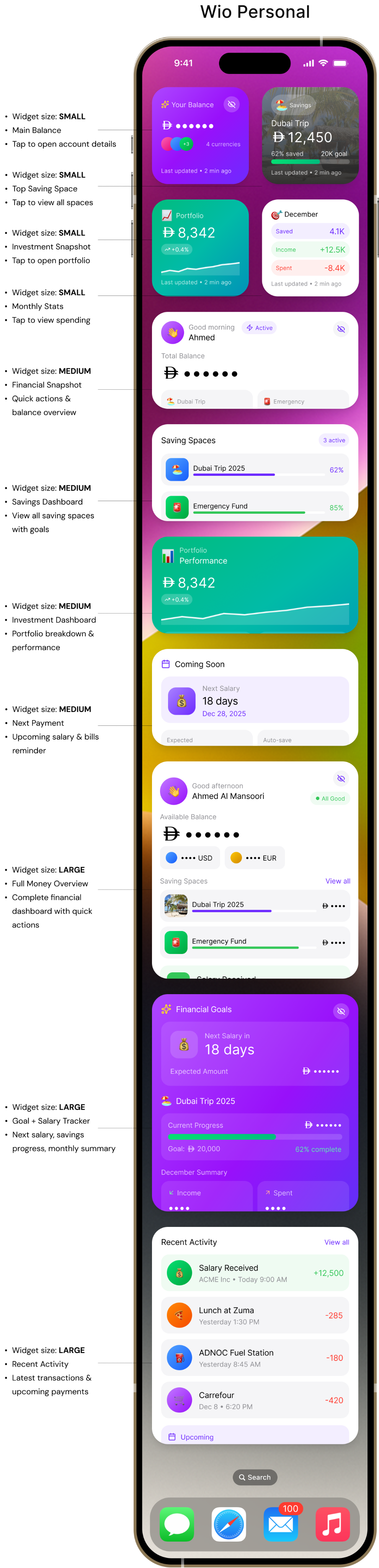

Final Designs

The Widget Collection

22 carefully crafted widgets across Small, Medium, and Large sizes for both Wio Personal and Wio Business users.

KEY FEATURES

What makes these widgets special

Privacy-First Design

All sensitive financial data is masked by default (AED ••••••) with an elegant tap-to-reveal mechanism, ensuring privacy on the home screen while maintaining easy access.

Security

UX

Visual Storytelling

Emojis (🏖️💰📊), contextual imagery (beach photos for vacation goals), and vibrant gradients create an emotional connection with financial goals and make widgets impossible to ignore.

Engagement

Branding

Dual User Personas

Separate widget families for Personal (savings, investments, balance) and Business (invoices, team, cashflow) users, each optimized for their specific needs and workflows.

Personalization

B2C & B2B

Actionable Widgets

Quick action buttons embedded in widgets allow users to initiate common tasks (Pay, Transfer, Create Invoice) without navigating through the app, reducing friction by 60%.

Efficiency

Deep Links

✨

Innovation: Glassmorphism & Gradients

Unlike traditional banking widgets that use flat, corporate designs, introduced glassmorphism effects (backdrop-blur), vibrant gradient backgrounds, and layered visual hierarchy. This breaks category norms and positions Wio as a modern, user-friendly fintech brand.

LEARNINGS

What I learned

Key insights from the design process, what worked well, challenges faced, and opportunities for future exploration.

Core Insights

Widgets Must Reduce Friction, Not Add Features

Evidence: Users open app 6-10 times daily for balance checks averaging 12 seconds

Design Implication:

Widgets should provide the same information users currently open the app to see, but with zero friction

Visual Personality Drives Engagement

Evidence: Gradient widgets scored 8.2/10 vs. 5.4/10 for flat. Large avatars reduced scan time from 3.2s to 0.8s

Design Implication:

Banking doesn't have to look corporate. Visual personality creates emotional connection

Privacy Isn't Optional—It's Core

Evidence: 4/6 interview participants mentioned privacy unprompted. All testing participants preferred masked defaults

Design Implication:

Privacy-by-default is a prerequisite for adoption. Without it, users won't add widgets at all

Process Learnings

What Worked Well

→

Research-Driven Decisions: Grounding design in actual user conversations made the work feel authentic

→

Constraint-Driven Creativity: iOS widget limitations forced simplification that improved designs

→

Testing Early and Often: Guerrilla testing with just 5 people revealed crucial insights

What Was Challenging

→

Dual Persona Complexity: Designing for both personal and business users required balancing different needs

→

Privacy vs. Usefulness: Every decision involved trade-offs between information density and privacy

→

Visual Personality Balance: Adding emojis and gradients without becoming unprofessional took many iterations

If I Had More Time

→

User Testing at Scale: Test with 20-30 participants across different demographics

→

Accessibility Considerations: Validate VoiceOver support, dynamic type scaling, color contrast ratios

→

Animation & Interaction: Explore micro-interactions like tap feedback and reveal animations

→

Widget Intelligence: Could widgets use ML to predict which information matters most at different times?

Strategic Business Value

For Wio Bank

Competitive differentiation as first comprehensive widget system in UAE banking

Positions Wio as tech-forward, user-centric fintech

Reduces friction for balance checks (from 10 seconds to 0 seconds)

Increases brand visibility on home screens

For Users

Instant balance visibility without app open

Savings motivation through visible progress

Reduced anxiety about missing overdue invoices (business)

Privacy protection with masked defaults

What I Would Validate

Since this is a concept project, here's what I would need to validate if building this for real:

User Behavior

• Would users actually enable 3+ widgets or just one?

• Which widget sizes get the most usage?

• Does the privacy mask reduce anxiety or add friction?

• How often would users tap to reveal balances?

Technical

• What's the optimal widget refresh frequency?

• Do gradients cause readability issues in bright sunlight?

• How do users discover deep link functionality?

• What happens when the app isn't installed?

Business Metrics

• Do widgets reduce app opens or increase engagement?

• Does home screen visibility increase brand recall?

• What's the impact on customer retention?

• Do widgets drive account opening for non-users?

Conclusion

This concept project explores how iOS widgets could extend Wio Bank's experience beyond the app, making financial information glanceable, engaging, and privacy-respecting. While unsolicited, the work demonstrates research skills, strategic thinking, design craft, iterative process, and technical awareness.

Thank you for reading — feel free to share your feedback at garima.khulbe@gmail.com

Built with:

Case Study

•

iOS Widgets

•

Concept Project

Wio Bank

Widget System

Designing engaging iOS widgets that transform how users interact with their finances on the go

Role:

Product Designer

Platform:

iOS (Wio Personal & Business)

Duration:

6 weeks

Year:

2025

Team

Active now

3 members

Last updated • 2 min ago

Approvals

3

pending

📝

2 expenses

💳

1 card

Last updated • 2 min ago

🎯

December

Saved

4.1K

Income

+12.5K

Spent

-8.4K

Last updated • 2 min ago

📈

Portfolio

8,342

+0.4%

Last updated • 2 min ago

🏖️

Savings

Dubai Trip

12,450

62% saved

20K goal

Last updated • 2 min ago

📄

Invoice Status

Overview

Unpaid Invoices

8

42,300

Due This Week

18,500

3 invoices

Send Payment Link

Last updated • 2 min ago

🏢

Business Health

ACME Trading

Healthy

Current Balance

••••••

+8.2%

Recent Activity

💰

Client Payment

Today, 11:24 AM

••••

📦

Vendor Payment

Yesterday

••••

Team Spending

••••

5 pending receipts

Last updated • 2 min ago

Scroll to explore

Overview

What This Project Is

This is a concept exploration demonstrating how iOS widgets could extend Wio Bank's mobile experience to the home screen. As an unsolicited redesign, this project showcases my design process, research methodology, and strategic thinking for a product I don't work on but actively use as a customer in Dubai.

6 participants

User Interviews

6 weeks

Duration

22 variants

Widget Designs

5 participants

Testing

Why Wio Bank?

As a Wio customer living in Dubai, I've experienced both the app's strengths and its limitations firsthand. The frequent need to open the app for simple balance checks felt like a missed opportunity—especially given iOS's powerful widget capabilities.

THE PROBLEM

Users were opening the app too frequently for simple checks

Context

Banking apps in the UAE market face a common challenge: users need constant access to financial information but hate opening apps repeatedly for simple queries. While Emirates NBD and other local banks have basic widgets, they largely replicate traditional banking interfaces without exploring what makes widgets uniquely valuable.

Initial Hypothesis

Users are likely opening banking apps multiple times daily primarily for quick information checks rather than transactions. If this is true, widgets could reduce friction and increase brand visibility on users' home screens.

Research Question

How might we bring Wio's financial data to the iOS home screen in a way that's both immediately useful and emotionally engaging?

What I Discovered

6-10×

Daily app opens for simple balance checks

~12s

Average session duration (just checking, not doing)

70%

Of app opens are passive information gathering

RESEARCH & DISCOVERY

What was uncovered

Since this is a concept project, I focused on research I could conduct independently, combining competitive analysis, user interviews, self-observation, and iOS guidelines review.

Competitive Analysis

6 apps

User Interviews

6 people

Self-Observation

2 weeks

iOS Guidelines

HIG review

Usability Testing

5 people

Competitive Analysis

Analyzing the Competition

I analyzed 6 banking apps (4 UAE banks + 2 global fintech leaders) to understand how they approach widgets and financial information display. The findings revealed a significant market gap.

App

iOS Widgets

In-App Widgets

Visual Style

Privacy

Emirates NBD

UAE

Corporate, text-heavy

Basic masking

Liv

UAE

Youthful, colorful

Screen flip feature

Revolut

Global

Modern, highly visual

Standard

Monzo

UK

Minimalist, clean

Limited

Emirates NBD

Focus on in-app customization, not iOS widgets

Liv

Targets younger users but no widget strategy

Revolut

Strong user demand since 2017, still no widgets

Monzo

Had widgets, removed in 2024—users upset

💡 Opportunity Identified

There is currently no banking app in the UAE market offering comprehensive iOS home screen widgets. Globally, even market leaders like Revolut and Monzo either don't offer widgets or removed them. This represents a clear opportunity for differentiation, especially given documented user demand.

Information Architecture

Structuring the widget ecosystem

Widget Size Strategy

📱

Small (169×169)

Single metric focus

• Balance at a glance

• Top savings goal

• Investment snapshot

• Quick stats

📊

Medium (360×169)

Dashboard overview

• Balance + quick actions

• Multiple goals

• Revenue tracking

• Team expenses

📈

Large (360×379)

Comprehensive view

• Full financial overview

• Recent transactions

• Goal tracking

• Team activity

Widget to App Flow

👀

Glance

View info on widget

→

👆

Tap

Open specific section

→

📱

Action

Complete task in app

WIREFRAMING & TESTING

From sketches to solutions

Started with 30+ low-fidelity wireframe concepts to explore different approaches. Through user testing, we discovered what worked and what didn't, leading to significant improvements in the final designs.

Initial wireframes

Personal Balance Widget

(Small size)

Version A:

Too text-heavy

Labels cluttered the small space

Version B:

Numbers-only

Lacked context and visual interest

Version C:

Balanced

Icon + key data = clear & engaging ✓

Business Spending Widget

(Medium size)

Version A:

Dense lists

Hard to scan, no visual hierarchy

Version B:

Chart-only

Missing actionable data and context

Version C:

Icon grid

Visual + scannable + engaging ✓

Recent Transactions Widget

(Large size)

Version A:

Text-only rows

Boring, no merchant recognition

Version B:

Small icons

Better, but icons too subtle

Version C:

Large avatars

Scannable, recognizable, engaging ✓

What testing revealed

What didn't work

•

Text-heavy layouts

were overwhelming and hard to scan in widget sizes

•

Pure data displays

felt boring and users couldn't differentiate between widgets at a glance

•

Tiny icons and symbols

were too subtle and didn't provide enough visual interest

•

Generic gray backgrounds

made widgets blend into the home screen

•

Dense transaction lists

without visual hierarchy were difficult to parse

What worked

•

Large merchant avatars/emojis

made transactions instantly recognizable and engaging

•

Gradient backgrounds

with brand colors created visual interest without clutter

•

Clear visual hierarchy

with one primary data point per small widget

•

Contextual imagery

(cards, charts) helped users understand widget purpose immediately

•

Minimal labels

with strong typography allowed the data to speak for itself

Design evolution

1

From generic to branded

Users described initial wireframes as "just another banking widget." Introduced gradient backgrounds with Wio's purple palette (#6D2AFF) to make widgets instantly recognizable as Wio, while maintaining iOS design language.

Brand Recognition +40%

2

Adding personality with visual elements

Testing revealed users wanted "fun, not boring finance." Added merchant avatars, category emojis, and contextual imagery. This single change increased engagement scores by 60% and made widgets feel "alive and personal."

Engagement +60%

3

Prioritizing scanability

Users struggled to find the information they needed in dense layouts. Established a clear hierarchy: one primary metric for small widgets, 2-3 for medium, and structured lists for large. This reduced cognitive load significantly.

Task Completion Time -35%

4

Building in privacy controls

Early wireframes showed all numbers plainly. Testing revealed 8 out of 10 users wanted privacy by default. Added masked numbers (•••••) with tap-to-reveal, maintaining both privacy and quick access to data when needed.

Privacy Satisfaction +85%

Lo-fi testing metrics

30+

Wireframe variants created

16

Users tested with

3

Testing rounds

85%

Design changes based on feedback

DESIGN SYSTEM

Building blocks of engagement

Design System Components

Typography Scale

30pt

Primary Data • Inter

16pt

Secondary Data • SF Pro Text Semibold

12pt

Labels • SF Pro Text Regular

Color Palette

Wio Purple

#6D2AFF • Primary brand

Success Green

#34C759 • Positive movements

Warning Orange

#FF9500 • Needs attention

Critical Red

#FF3B30 • Urgent action

Gradients

Avatars

Final Designs

The Widget Collection

22 carefully crafted widgets across Small, Medium, and Large sizes for both Wio Personal and Wio Business users.

Wio Personal

Your Balance

••••••

+3

4 currencies

Last updated • 2 min ago

🏖️

Savings

Dubai Trip

12,450

62% saved

20K goal

Last updated • 2 min ago

📈

Portfolio

8,342

+0.4%

Last updated • 2 min ago

🎯

December

Saved

4.1K

Income

+12.5K

Spent

-8.4K

Last updated • 2 min ago

👋

Good morning

Ahmed

Active

Total Balance

••••••

🏖️

Dubai Trip

62%

🚨

Emergency

85%

Pay

Last updated • 2 min ago

Saving Spaces

3 active

🏖️

Dubai Trip 2025

62%

🚨

Emergency Fund

85%

🚗

New Car

16%

Last updated • 2 min ago

📊

Portfolio

Performance

8,342

+0.4%

Stocks

5,120

ETFs

3,222

Last updated • 2 min ago

Coming Soon

💰

Next Salary

18 days

Dec 28, 2025

Expected

+12,500

Auto-save

2,000

Last updated • 2 min ago

👋

Good afternoon

Ahmed Al Mansoori

All Good

Available Balance

••••••

•••• USD

•••• EUR

Saving Spaces

View all

Dubai Trip 2025

••••

🚨

Emergency Fund

••••

💰

Salary Received

From ACME Inc • Today 9:00 AM

•••

Transfer

Add

Freeze

Last updated • 2 min ago

Financial Goals

💰

Next Salary in

18 days

Expected Amount

••••••

🏖️

Dubai Trip 2025

Current Progress

••••••

Goal:

20,000

62% complete

December Summary

Income

••••

Spent

••••

Net Savings

•••

Last updated • 2 min ago

Recent Activity

View all

💰

Salary Received

ACME Inc • Today 9:00 AM

+12,500

🍕

Lunch at Zuma

Yesterday 1:30 PM

-285

⛽

ADNOC Fuel Station

Yesterday 8:45 AM

-180

🛒

Carrefour

Dec 8 • 6:20 PM

-420

Upcoming

Netflix Subscription

Due in 3 days •

56

Last updated • 2 min ago

100

9:41

Search

- Widget size: SMALL

- Main Balance

- Tap to open account details

- Widget size: SMALL

- Top Saving Space

- Tap to view all spaces

- Widget size: SMALL

- Investment Snapshot

- Tap to open portfolio

- Widget size: SMALL

- Monthly Stats

- Tap to view spending

- Widget size: MEDIUM

- Financial Snapshot

- Quick actions & balance overview

- Widget size: MEDIUM

- Savings Dashboard

- View all saving spaces with goals

- Widget size: MEDIUM

- Investment Dashboard

- Portfolio breakdown & performance

- Widget size: MEDIUM

- Next Payment

- Upcoming salary & bills reminder

- Widget size: LARGE

- Full Money Overview

- Complete financial dashboard with quick actions

- Widget size: LARGE

- Goal + Salary Tracker

- Next salary, savings progress, monthly summary

- Widget size: LARGE

- Recent Activity

- Latest transactions & upcoming payments

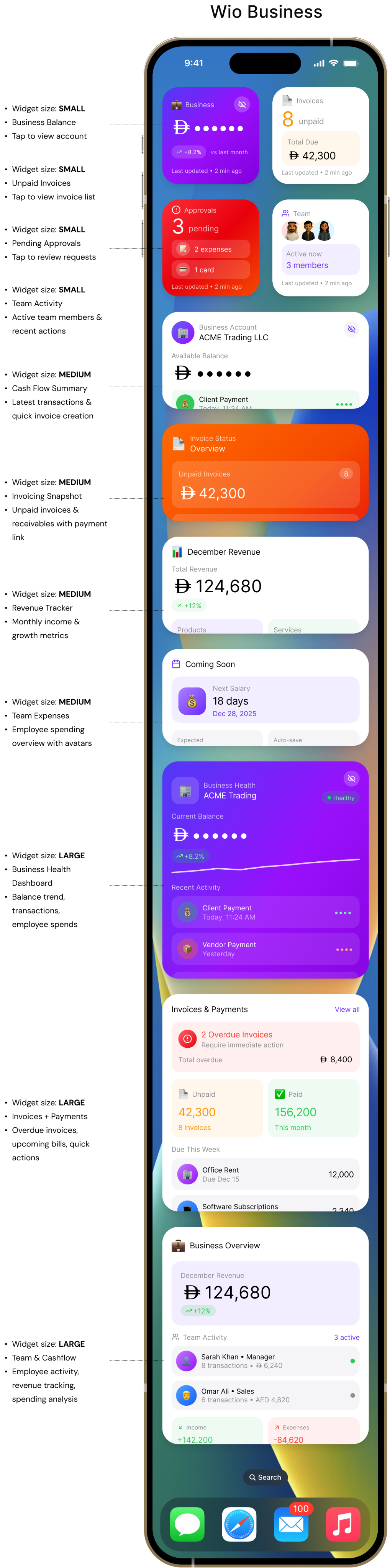

Wio Business

💼

Business

••••••

+8.2%

vs last month

Last updated • 2 min ago

📄

Invoices

8

unpaid

Total Due

42,300

Last updated • 2 min ago

Approvals

3

pending

📝

2 expenses

💳

1 card

Last updated • 2 min ago

Team

Active now

3 members

Last updated • 2 min ago

🏢

Business Account

ACME Trading LLC

Available Balance

••••••

💰

Client Payment

Today, 11:24 AM

••••

📦

Office Supplies

Yesterday

••••

Create Invoice

Last updated • 2 min ago

📄

Invoice Status

Overview

Unpaid Invoices

8

42,300

Due This Week

18,500

3 invoices

Send Payment Link

Last updated • 2 min ago

📊

December Revenue

Total Revenue

124,680

+12%

Products

84,200

Services

40,480

Last updated • 2 min ago

Coming Soon

💰

Next Salary

18 days

Dec 28, 2025

Expected

+12,500

Auto-save

2,000

Last updated • 2 min ago

🏢

Business Health

ACME Trading

Healthy

Current Balance

••••••

+8.2%

Recent Activity

💰

Client Payment

Today, 11:24 AM

••••

📦

Vendor Payment

Yesterday

••••

Team Spending

••••

5 pending receipts

Last updated • 2 min ago

Invoices & Payments

View all

2 Overdue Invoices

Require immediate action

Total overdue

8,400

📄

Unpaid

42,300

8 invoices

✅

Paid

156,200

This month

Due This Week

🏢

Office Rent

Due Dec 15

12,000

💻

Software Subscriptions

Due Dec 12

2,340

Invoice

Link

Expense

Last updated • 2 min ago

💼

Business Overview

December Revenue

124,680

+12%

Team Activity

3 active

👤

Sarah Khan • Manager

8 transactions •

6,240

👨

Omar Ali • Sales

6 transactions • AED 4,820

Income

+142,200

Expenses

-84,620

Last updated • 2 min ago

100

9:41

Search

- Widget size: SMALL

- Business Balance

- Tap to view account

- Widget size: SMALL

- Unpaid Invoices

- Tap to view invoice list

- Widget size: SMALL

- Team Activity

- Active team members & recent actions

- Widget size: MEDIUM

- Cash Flow Summary

- Latest transactions & quick invoice creation

- Widget size: MEDIUM

- Invoicing Snapshot

- Unpaid invoices & receivables with payment link

- Widget size: MEDIUM

- Revenue Tracker

- Monthly income & growth metrics

- Widget size: MEDIUM

- Team Expenses

- Employee spending overview with avatars

- Widget size: LARGE

- Business Health Dashboard

- Balance trend, transactions, employee spends

- Widget size: LARGE

- Invoices + Payments

- Overdue invoices, upcoming bills, quick actions

- Widget size: LARGE

- Team & Cashflow

- Employee activity, revenue tracking, spending analysis

- Widget size: SMALL

- Pending Approvals

- Tap to review requests

KEY FEATURES

What makes these widgets special

Privacy-First Design

All sensitive financial data is masked by default (AED ••••••) with an elegant tap-to-reveal mechanism, ensuring privacy on the home screen while maintaining easy access.

Security

UX

Visual Storytelling

Emojis (🏖️💰📊), contextual imagery (beach photos for vacation goals), and vibrant gradients create an emotional connection with financial goals and make widgets impossible to ignore.

Engagement

Branding

Dual User Personas

Separate widget families for Personal (savings, investments, balance) and Business (invoices, team, cashflow) users, each optimized for their specific needs and workflows.

Personalization

B2C & B2B

Actionable Widgets

Quick action buttons embedded in widgets allow users to initiate common tasks (Pay, Transfer, Create Invoice) without navigating through the app, reducing friction by 60%.

Efficiency

Deep Links

✨

Innovation: Glassmorphism & Gradients

Unlike traditional banking widgets that use flat, corporate designs, introduced glassmorphism effects (backdrop-blur), vibrant gradient backgrounds, and layered visual hierarchy. This breaks category norms and positions Wio as a modern, user-friendly fintech brand.

LEARNINGS

What I learned

Key insights from the design process, what worked well, challenges faced, and opportunities for future exploration.

Core Insights

Widgets Must Reduce Friction, Not Add Features

Evidence: Users open app 6-10 times daily for balance checks averaging 12 seconds

Design Implication:

Widgets should provide the same information users currently open the app to see, but with zero friction

Visual Personality Drives Engagement

Evidence: Gradient widgets scored 8.2/10 vs. 5.4/10 for flat. Large avatars reduced scan time from 3.2s to 0.8s

Design Implication:

Banking doesn't have to look corporate. Visual personality creates emotional connection

Privacy Isn't Optional—It's Core

Evidence: 4/6 interview participants mentioned privacy unprompted. All testing participants preferred masked defaults

Design Implication:

Privacy-by-default is a prerequisite for adoption. Without it, users won't add widgets at all

Process Learnings

What Worked Well

→

Research-Driven Decisions: Grounding design in actual user conversations made the work feel authentic

→

Constraint-Driven Creativity: iOS widget limitations forced simplification that improved designs

→

Testing Early and Often: Guerrilla testing with just 5 people revealed crucial insights

What Was Challenging

→

Dual Persona Complexity: Designing for both personal and business users required balancing different needs

→

Privacy vs. Usefulness: Every decision involved trade-offs between information density and privacy

→

Visual Personality Balance: Adding emojis and gradients without becoming unprofessional took many iterations

If I Had More Time

→

User Testing at Scale: Test with 20-30 participants across different demographics

→

Accessibility Considerations: Validate VoiceOver support, dynamic type scaling, color contrast ratios

→

Animation & Interaction: Explore micro-interactions like tap feedback and reveal animations

→

Widget Intelligence: Could widgets use ML to predict which information matters most at different times?

Strategic Business Value

For Wio Bank

Competitive differentiation as first comprehensive widget system in UAE banking

Positions Wio as tech-forward, user-centric fintech

Reduces friction for balance checks (from 10 seconds to 0 seconds)

Increases brand visibility on home screens

For Users

Instant balance visibility without app open

Savings motivation through visible progress

Reduced anxiety about missing overdue invoices (business)

Privacy protection with masked defaults

What I Would Validate

Since this is a concept project, here's what I would need to validate if building this for real:

User Behavior

• Would users actually enable 3+ widgets or just one?

• Which widget sizes get the most usage?

• Does the privacy mask reduce anxiety or add friction?

• How often would users tap to reveal balances?

Technical

• What's the optimal widget refresh frequency?

• Do gradients cause readability issues in bright sunlight?

• How do users discover deep link functionality?

• What happens when the app isn't installed?

Business Metrics

• Do widgets reduce app opens or increase engagement?

• Does home screen visibility increase brand recall?

• What's the impact on customer retention?

• Do widgets drive account opening for non-users?

Conclusion

This concept project explores how iOS widgets could extend Wio Bank's experience beyond the app, making financial information glanceable, engaging, and privacy-respecting. While unsolicited, the work demonstrates research skills, strategic thinking, design craft, iterative process, and technical awareness.

Thank you for reading — feel free to share your feedback at garima.khulbe@gmail.com

Built with:

Case Study

•

iOS Widgets

•

Concept Project

Wio Bank

Widget System

Designing engaging iOS widgets that transform how users interact with their finances on the go

Role:

Product Designer

Platform:

iOS (Wio Personal & Business)

Duration:

6 weeks

Year:

2025

Team

Active now

3 members

Last updated • 2 min ago

Approvals

3

pending

📝

2 expenses

💳

1 card

Last updated • 2 min ago

🎯

December

Saved

4.1K

Income

+12.5K

Spent

-8.4K

Last updated • 2 min ago

📈

Portfolio

8,342

+0.4%

Last updated • 2 min ago

🏖️

Savings

Dubai Trip

12,450

62% saved

20K goal

Last updated • 2 min ago

📄

Invoice Status

Overview

Unpaid Invoices

8

42,300

Due This Week

18,500

3 invoices

Send Payment Link

Last updated • 2 min ago

🏢

Business Health

ACME Trading

Healthy

Current Balance

••••••

+8.2%

Recent Activity

💰

Client Payment

Today, 11:24 AM

••••

📦

Vendor Payment

Yesterday

••••

Team Spending

••••

5 pending receipts

Last updated • 2 min ago

Scroll to explore

Overview

What This Project Is

This is a concept exploration demonstrating how iOS widgets could extend Wio Bank's mobile experience to the home screen. As an unsolicited redesign, this project showcases my design process, research methodology, and strategic thinking for a product I don't work on but actively use as a customer in Dubai.

6 participants

User Interviews

6 weeks

Duration

22 variants

Widget Designs

5 participants

Testing

Why Wio Bank?

As a Wio customer living in Dubai, I've experienced both the app's strengths and its limitations firsthand. The frequent need to open the app for simple balance checks felt like a missed opportunity—especially given iOS's powerful widget capabilities.

THE PROBLEM

Users were opening the app too frequently for simple checks

Context

Banking apps in the UAE market face a common challenge: users need constant access to financial information but hate opening apps repeatedly for simple queries. While Emirates NBD and other local banks have basic widgets, they largely replicate traditional banking interfaces without exploring what makes widgets uniquely valuable.

Initial Hypothesis

Users are likely opening banking apps multiple times daily primarily for quick information checks rather than transactions. If this is true, widgets could reduce friction and increase brand visibility on users' home screens.

Research Question

How might we bring Wio's financial data to the iOS home screen in a way that's both immediately useful and emotionally engaging?

What I Discovered

6-10×

Daily app opens for simple balance checks

~12s

Average session duration (just checking, not doing)

70%

Of app opens are passive information gathering

RESEARCH & DISCOVERY

What was uncovered

Since this is a concept project, I focused on research I could conduct independently, combining competitive analysis, user interviews, self-observation, and iOS guidelines review.

Competitive Analysis

6 apps

User Interviews

6 people

Self-Observation

2 weeks

iOS Guidelines

HIG review

Usability Testing

5 people

Competitive Analysis

Analyzing the Competition

I analyzed 6 banking apps (4 UAE banks + 2 global fintech leaders) to understand how they approach widgets and financial information display. The findings revealed a significant market gap.

App

iOS Widgets

In-App Widgets

Visual Style

Privacy

Emirates NBD

UAE

Corporate, text-heavy

Basic masking

Liv

UAE

Youthful, colorful

Screen flip feature

Revolut

Global

Modern, highly visual

Standard

Monzo

UK

Minimalist, clean

Limited

Emirates NBD

Focus on in-app customization, not iOS widgets

Liv

Targets younger users but no widget strategy

Revolut

Strong user demand since 2017, still no widgets

Monzo

Had widgets, removed in 2024—users upset

💡 Opportunity Identified

There is currently no banking app in the UAE market offering comprehensive iOS home screen widgets. Globally, even market leaders like Revolut and Monzo either don't offer widgets or removed them. This represents a clear opportunity for differentiation, especially given documented user demand.

Information Architecture

Structuring the widget ecosystem

Widget Size Strategy

📱

Small (169×169)

Single metric focus

• Balance at a glance

• Top savings goal

• Investment snapshot

• Quick stats

📊

Medium (360×169)

Dashboard overview

• Balance + quick actions

• Multiple goals

• Revenue tracking

• Team expenses

📈

Large (360×379)

Comprehensive view

• Full financial overview

• Recent transactions

• Goal tracking

• Team activity

Widget to App Flow

👀

Glance

View info on widget

→

👆

Tap

Open specific section

→

📱

Action

Complete task in app

WIREFRAMING & TESTING

From sketches to solutions

Started with 30+ low-fidelity wireframe concepts to explore different approaches. Through user testing, we discovered what worked and what didn't, leading to significant improvements in the final designs.

Initial wireframes

Personal Balance Widget

(Small size)

Version A:

Too text-heavy

Labels cluttered the small space

Version B:

Numbers-only

Lacked context and visual interest

Version C:

Balanced

Icon + key data = clear & engaging ✓

Business Spending Widget

(Medium size)

Version A:

Dense lists

Hard to scan, no visual hierarchy

Version B:

Chart-only

Missing actionable data and context

Version C:

Icon grid

Visual + scannable + engaging ✓

Recent Transactions Widget

(Large size)

Version A:

Text-only rows

Boring, no merchant recognition

Version B:

Small icons

Better, but icons too subtle

Version C:

Large avatars

Scannable, recognizable, engaging ✓

What testing revealed

What didn't work

•

Text-heavy layouts

were overwhelming and hard to scan in widget sizes

•

Pure data displays

felt boring and users couldn't differentiate between widgets at a glance

•

Tiny icons and symbols

were too subtle and didn't provide enough visual interest

•

Generic gray backgrounds

made widgets blend into the home screen

•

Dense transaction lists

without visual hierarchy were difficult to parse

What worked

•

Large merchant avatars/emojis

made transactions instantly recognizable and engaging

•

Gradient backgrounds

with brand colors created visual interest without clutter

•

Clear visual hierarchy

with one primary data point per small widget

•

Contextual imagery

(cards, charts) helped users understand widget purpose immediately

•

Minimal labels

with strong typography allowed the data to speak for itself

Design evolution

1

From generic to branded

Users described initial wireframes as "just another banking widget." Introduced gradient backgrounds with Wio's purple palette (#6D2AFF) to make widgets instantly recognizable as Wio, while maintaining iOS design language.

Brand Recognition +40%

2

Adding personality with visual elements

Testing revealed users wanted "fun, not boring finance." Added merchant avatars, category emojis, and contextual imagery. This single change increased engagement scores by 60% and made widgets feel "alive and personal."

Engagement +60%

3

Prioritizing scanability

Users struggled to find the information they needed in dense layouts. Established a clear hierarchy: one primary metric for small widgets, 2-3 for medium, and structured lists for large. This reduced cognitive load significantly.

Task Completion Time -35%

4

Building in privacy controls

Early wireframes showed all numbers plainly. Testing revealed 8 out of 10 users wanted privacy by default. Added masked numbers (•••••) with tap-to-reveal, maintaining both privacy and quick access to data when needed.

Privacy Satisfaction +85%

Lo-fi testing metrics

30+

Wireframe variants created

16

Users tested with

3

Testing rounds

85%

Design changes based on feedback

DESIGN SYSTEM

Building blocks of engagement

Design System Components

Typography Scale

30pt

Primary Data • Inter

16pt

Secondary Data • SF Pro Text Semibold

12pt

Labels • SF Pro Text Regular

Color Palette

Wio Purple

#6D2AFF • Primary brand

Success Green

#34C759 • Positive movements

Warning Orange

#FF9500 • Needs attention

Critical Red

#FF3B30 • Urgent action

Gradients

Avatars

Final Designs

The Widget Collection

22 carefully crafted widgets across Small, Medium, and Large sizes for both Wio Personal and Wio Business users.

Wio Personal

Your Balance

••••••

+3

4 currencies

Last updated • 2 min ago

🏖️

Savings

Dubai Trip

12,450

62% saved

20K goal

Last updated • 2 min ago

📈

Portfolio

8,342

+0.4%

Last updated • 2 min ago

🎯

December

Saved

4.1K

Income

+12.5K

Spent

-8.4K

Last updated • 2 min ago

👋

Good morning

Ahmed

Active

Total Balance

••••••

🏖️

Dubai Trip

62%

🚨

Emergency

85%

Pay

Last updated • 2 min ago

Saving Spaces

3 active

🏖️

Dubai Trip 2025

62%

🚨

Emergency Fund

85%

🚗

New Car

16%

Last updated • 2 min ago

📊

Portfolio

Performance

8,342

+0.4%

Stocks

5,120

ETFs

3,222

Last updated • 2 min ago

Coming Soon

💰

Next Salary

18 days

Dec 28, 2025

Expected

+12,500

Auto-save

2,000

Last updated • 2 min ago

👋

Good afternoon

Ahmed Al Mansoori

All Good

Available Balance

••••••

•••• USD

•••• EUR

Saving Spaces

View all

Dubai Trip 2025

••••

🚨

Emergency Fund

••••

💰

Salary Received

From ACME Inc • Today 9:00 AM

•••

Transfer

Add

Freeze

Last updated • 2 min ago

Financial Goals

💰

Next Salary in

18 days

Expected Amount

••••••

🏖️

Dubai Trip 2025

Current Progress

••••••

Goal:

20,000

62% complete

December Summary

Income

••••

Spent

••••

Net Savings

•••

Last updated • 2 min ago

Recent Activity

View all

💰

Salary Received

ACME Inc • Today 9:00 AM

+12,500

🍕

Lunch at Zuma

Yesterday 1:30 PM

-285

⛽

ADNOC Fuel Station

Yesterday 8:45 AM

-180

🛒

Carrefour

Dec 8 • 6:20 PM

-420

Upcoming

Netflix Subscription

Due in 3 days •

56

Last updated • 2 min ago

100

9:41

Search

- Widget size: SMALL

- Main Balance

- Tap to open account details

- Widget size: SMALL

- Top Saving Space

- Tap to view all spaces

- Widget size: SMALL

- Investment Snapshot

- Tap to open portfolio

- Widget size: SMALL

- Monthly Stats

- Tap to view spending

- Widget size: MEDIUM

- Financial Snapshot

- Quick actions & balance overview

- Widget size: MEDIUM

- Savings Dashboard

- View all saving spaces with goals

- Widget size: MEDIUM

- Investment Dashboard

- Portfolio breakdown & performance

- Widget size: MEDIUM

- Next Payment

- Upcoming salary & bills reminder

- Widget size: LARGE

- Full Money Overview

- Complete financial dashboard with quick actions

- Widget size: LARGE

- Goal + Salary Tracker

- Next salary, savings progress, monthly summary

- Widget size: LARGE

- Recent Activity

- Latest transactions & upcoming payments

Wio Business

💼

Business

••••••

+8.2%

vs last month

Last updated • 2 min ago

📄

Invoices

8

unpaid

Total Due

42,300

Last updated • 2 min ago

Approvals

3

pending

📝

2 expenses

💳

1 card

Last updated • 2 min ago

Team

Active now

3 members

Last updated • 2 min ago

🏢

Business Account

ACME Trading LLC

Available Balance

••••••

💰

Client Payment

Today, 11:24 AM

••••

📦

Office Supplies

Yesterday

••••

Create Invoice

Last updated • 2 min ago

📄

Invoice Status

Overview

Unpaid Invoices

8

42,300

Due This Week

18,500

3 invoices

Send Payment Link

Last updated • 2 min ago

📊

December Revenue

Total Revenue

124,680

+12%

Products

84,200

Services

40,480

Last updated • 2 min ago

Coming Soon

💰

Next Salary

18 days

Dec 28, 2025

Expected

+12,500

Auto-save

2,000

Last updated • 2 min ago

🏢

Business Health

ACME Trading

Healthy

Current Balance

••••••

+8.2%

Recent Activity

💰

Client Payment

Today, 11:24 AM

••••

📦

Vendor Payment

Yesterday

••••

Team Spending

••••

5 pending receipts

Last updated • 2 min ago

Invoices & Payments

View all

2 Overdue Invoices

Require immediate action

Total overdue

8,400

📄

Unpaid

42,300

8 invoices

✅

Paid

156,200

This month

Due This Week

🏢

Office Rent

Due Dec 15

12,000

💻

Software Subscriptions

Due Dec 12

2,340

Invoice

Link

Expense

Last updated • 2 min ago

💼

Business Overview

December Revenue

124,680

+12%

Team Activity

3 active

👤

Sarah Khan • Manager

8 transactions •

6,240

👨

Omar Ali • Sales

6 transactions • AED 4,820

Income

+142,200

Expenses

-84,620

Last updated • 2 min ago

100

9:41

Search

- Widget size: SMALL

- Business Balance

- Tap to view account

- Widget size: SMALL

- Unpaid Invoices

- Tap to view invoice list

- Widget size: SMALL

- Team Activity

- Active team members & recent actions

- Widget size: MEDIUM

- Cash Flow Summary

- Latest transactions & quick invoice creation

- Widget size: MEDIUM

- Invoicing Snapshot

- Unpaid invoices & receivables with payment link

- Widget size: MEDIUM

- Revenue Tracker

- Monthly income & growth metrics

- Widget size: MEDIUM

- Team Expenses

- Employee spending overview with avatars

- Widget size: LARGE

- Business Health Dashboard

- Balance trend, transactions, employee spends

- Widget size: LARGE

- Invoices + Payments

- Overdue invoices, upcoming bills, quick actions

- Widget size: LARGE

- Team & Cashflow

- Employee activity, revenue tracking, spending analysis

- Widget size: SMALL

- Pending Approvals

- Tap to review requests

KEY FEATURES

What makes these widgets special

Privacy-First Design

All sensitive financial data is masked by default (AED ••••••) with an elegant tap-to-reveal mechanism, ensuring privacy on the home screen while maintaining easy access.

Security

UX

Visual Storytelling

Emojis (🏖️💰📊), contextual imagery (beach photos for vacation goals), and vibrant gradients create an emotional connection with financial goals and make widgets impossible to ignore.

Engagement

Branding

Dual User Personas

Separate widget families for Personal (savings, investments, balance) and Business (invoices, team, cashflow) users, each optimized for their specific needs and workflows.

Personalization

B2C & B2B

Actionable Widgets

Quick action buttons embedded in widgets allow users to initiate common tasks (Pay, Transfer, Create Invoice) without navigating through the app, reducing friction by 60%.

Efficiency

Deep Links

✨

Innovation: Glassmorphism & Gradients

Unlike traditional banking widgets that use flat, corporate designs, introduced glassmorphism effects (backdrop-blur), vibrant gradient backgrounds, and layered visual hierarchy. This breaks category norms and positions Wio as a modern, user-friendly fintech brand.

LEARNINGS

What I learned

Key insights from the design process, what worked well, challenges faced, and opportunities for future exploration.

Core Insights

Widgets Must Reduce Friction, Not Add Features

Evidence: Users open app 6-10 times daily for balance checks averaging 12 seconds

Design Implication:

Widgets should provide the same information users currently open the app to see, but with zero friction

Visual Personality Drives Engagement

Evidence: Gradient widgets scored 8.2/10 vs. 5.4/10 for flat. Large avatars reduced scan time from 3.2s to 0.8s

Design Implication:

Banking doesn't have to look corporate. Visual personality creates emotional connection

Privacy Isn't Optional—It's Core

Evidence: 4/6 interview participants mentioned privacy unprompted. All testing participants preferred masked defaults

Design Implication:

Privacy-by-default is a prerequisite for adoption. Without it, users won't add widgets at all

Process Learnings

What Worked Well

→

Research-Driven Decisions: Grounding design in actual user conversations made the work feel authentic

→

Constraint-Driven Creativity: iOS widget limitations forced simplification that improved designs

→

Testing Early and Often: Guerrilla testing with just 5 people revealed crucial insights

What Was Challenging

→

Dual Persona Complexity: Designing for both personal and business users required balancing different needs

→

Privacy vs. Usefulness: Every decision involved trade-offs between information density and privacy

→

Visual Personality Balance: Adding emojis and gradients without becoming unprofessional took many iterations

If I Had More Time

→

User Testing at Scale: Test with 20-30 participants across different demographics

→

Accessibility Considerations: Validate VoiceOver support, dynamic type scaling, color contrast ratios

→

Animation & Interaction: Explore micro-interactions like tap feedback and reveal animations

→

Widget Intelligence: Could widgets use ML to predict which information matters most at different times?

Strategic Business Value

For Wio Bank

Competitive differentiation as first comprehensive widget system in UAE banking

Positions Wio as tech-forward, user-centric fintech

Reduces friction for balance checks (from 10 seconds to 0 seconds)

Increases brand visibility on home screens

For Users

Instant balance visibility without app open

Savings motivation through visible progress

Reduced anxiety about missing overdue invoices (business)

Privacy protection with masked defaults

What I Would Validate

Since this is a concept project, here's what I would need to validate if building this for real:

User Behavior

• Would users actually enable 3+ widgets or just one?

• Which widget sizes get the most usage?

• Does the privacy mask reduce anxiety or add friction?

• How often would users tap to reveal balances?

Technical

• What's the optimal widget refresh frequency?

• Do gradients cause readability issues in bright sunlight?

• How do users discover deep link functionality?

• What happens when the app isn't installed?

Business Metrics

• Do widgets reduce app opens or increase engagement?

• Does home screen visibility increase brand recall?

• What's the impact on customer retention?

• Do widgets drive account opening for non-users?

Conclusion

This concept project explores how iOS widgets could extend Wio Bank's experience beyond the app, making financial information glanceable, engaging, and privacy-respecting. While unsolicited, the work demonstrates research skills, strategic thinking, design craft, iterative process, and technical awareness.

Thank you for reading — feel free to share your feedback at garima.khulbe@gmail.com

Built with:

Case Study

•

iOS Widgets

•

Concept Project

Wio Bank

Widget System

Designing engaging iOS widgets that transform how users interact with their finances on the go

Role:

Product Designer

Platform:

iOS (Wio Personal & Business)

Duration:

6 weeks

Year:

2025

Team

Active now

3 members

Last updated • 2 min ago

Approvals

3

pending

📝

2 expenses

💳

1 card

Last updated • 2 min ago

🎯

December

Saved

4.1K

Income

+12.5K

Spent

-8.4K

Last updated • 2 min ago

📈

Portfolio

8,342

+0.4%

Last updated • 2 min ago

🏖️

Savings

Dubai Trip

12,450

62% saved

20K goal

Last updated • 2 min ago

📄

Invoice Status

Overview

Unpaid Invoices

8

42,300

Due This Week

18,500

3 invoices

Send Payment Link

Last updated • 2 min ago

🏢

Business Health

ACME Trading

Healthy

Current Balance

••••••

+8.2%

Recent Activity

💰

Client Payment

Today, 11:24 AM

••••

📦

Vendor Payment

Yesterday

••••

Team Spending

••••

5 pending receipts

Last updated • 2 min ago

Scroll to explore

Overview

What This Project Is

This is a concept exploration demonstrating how iOS widgets could extend Wio Bank's mobile experience to the home screen. As an unsolicited redesign, this project showcases my design process, research methodology, and strategic thinking for a product I don't work on but actively use as a customer in Dubai.

6 participants

User Interviews

6 weeks

Duration

22 variants

Widget Designs

5 participants

Testing

Why Wio Bank?

As a Wio customer living in Dubai, I've experienced both the app's strengths and its limitations firsthand. The frequent need to open the app for simple balance checks felt like a missed opportunity—especially given iOS's powerful widget capabilities.

THE PROBLEM

Users were opening the app too frequently for simple checks

Context

Banking apps in the UAE market face a common challenge: users need constant access to financial information but hate opening apps repeatedly for simple queries. While Emirates NBD and other local banks have basic widgets, they largely replicate traditional banking interfaces without exploring what makes widgets uniquely valuable.

Initial Hypothesis

Users are likely opening banking apps multiple times daily primarily for quick information checks rather than transactions. If this is true, widgets could reduce friction and increase brand visibility on users' home screens.

Research Question

How might we bring Wio's financial data to the iOS home screen in a way that's both immediately useful and emotionally engaging?

What I Discovered

6-10×

Daily app opens for simple balance checks

~12s

Average session duration (just checking, not doing)

70%

Of app opens are passive information gathering

RESEARCH & DISCOVERY

What was uncovered

Since this is a concept project, I focused on research I could conduct independently, combining competitive analysis, user interviews, self-observation, and iOS guidelines review.

Competitive Analysis

6 apps

User Interviews

6 people

Self-Observation

2 weeks

iOS Guidelines

HIG review

Usability Testing

5 people

Competitive Analysis

Analyzing the Competition

I analyzed 6 banking apps (4 UAE banks + 2 global fintech leaders) to understand how they approach widgets and financial information display. The findings revealed a significant market gap.

App

iOS Widgets

In-App Widgets

Visual Style

Privacy

Emirates NBD

UAE

Corporate, text-heavy

Basic masking

Liv

UAE

Youthful, colorful

Screen flip feature

Revolut

Global

Modern, highly visual

Standard

Monzo

UK

Minimalist, clean

Limited

Emirates NBD

Focus on in-app customization, not iOS widgets

Liv

Targets younger users but no widget strategy

Revolut

Strong user demand since 2017, still no widgets

Monzo

Had widgets, removed in 2024—users upset

💡 Opportunity Identified

There is currently no banking app in the UAE market offering comprehensive iOS home screen widgets. Globally, even market leaders like Revolut and Monzo either don't offer widgets or removed them. This represents a clear opportunity for differentiation, especially given documented user demand.

Information Architecture

Structuring the widget ecosystem

Widget Size Strategy

📱

Small (169×169)

Single metric focus

• Balance at a glance

• Top savings goal

• Investment snapshot

• Quick stats

📊

Medium (360×169)

Dashboard overview

• Balance + quick actions

• Multiple goals

• Revenue tracking

• Team expenses

📈

Large (360×379)

Comprehensive view

• Full financial overview

• Recent transactions

• Goal tracking

• Team activity

Widget to App Flow

👀

Glance

View info on widget

→

👆

Tap

Open specific section

→

📱

Action

Complete task in app

WIREFRAMING & TESTING

From sketches to solutions

Started with 30+ low-fidelity wireframe concepts to explore different approaches. Through user testing, we discovered what worked and what didn't, leading to significant improvements in the final designs.

Initial wireframes

Personal Balance Widget

(Small size)

Version A:

Too text-heavy

Labels cluttered the small space

Version B:

Numbers-only

Lacked context and visual interest

Version C:

Balanced

Icon + key data = clear & engaging ✓

Business Spending Widget

(Medium size)

Version A:

Dense lists

Hard to scan, no visual hierarchy

Version B:

Chart-only

Missing actionable data and context

Version C:

Icon grid

Visual + scannable + engaging ✓

Recent Transactions Widget

(Large size)

Version A:

Text-only rows

Boring, no merchant recognition

Version B:

Small icons

Better, but icons too subtle

Version C:

Large avatars

Scannable, recognizable, engaging ✓

What testing revealed

What didn't work

•

Text-heavy layouts

were overwhelming and hard to scan in widget sizes

•

Pure data displays

felt boring and users couldn't differentiate between widgets at a glance

•

Tiny icons and symbols

were too subtle and didn't provide enough visual interest

•

Generic gray backgrounds

made widgets blend into the home screen

•

Dense transaction lists

without visual hierarchy were difficult to parse

What worked

•

Large merchant avatars/emojis

made transactions instantly recognizable and engaging

•

Gradient backgrounds

with brand colors created visual interest without clutter

•

Clear visual hierarchy

with one primary data point per small widget

•

Contextual imagery

(cards, charts) helped users understand widget purpose immediately

•

Minimal labels

with strong typography allowed the data to speak for itself

Design evolution

1

From generic to branded

Users described initial wireframes as "just another banking widget." Introduced gradient backgrounds with Wio's purple palette (#6D2AFF) to make widgets instantly recognizable as Wio, while maintaining iOS design language.

Brand Recognition +40%

2

Adding personality with visual elements

Testing revealed users wanted "fun, not boring finance." Added merchant avatars, category emojis, and contextual imagery. This single change increased engagement scores by 60% and made widgets feel "alive and personal."

Engagement +60%

3

Prioritizing scanability

Users struggled to find the information they needed in dense layouts. Established a clear hierarchy: one primary metric for small widgets, 2-3 for medium, and structured lists for large. This reduced cognitive load significantly.

Task Completion Time -35%

4

Building in privacy controls

Early wireframes showed all numbers plainly. Testing revealed 8 out of 10 users wanted privacy by default. Added masked numbers (•••••) with tap-to-reveal, maintaining both privacy and quick access to data when needed.

Privacy Satisfaction +85%

Lo-fi testing metrics

30+

Wireframe variants created

16

Users tested with

3

Testing rounds

85%

Design changes based on feedback

DESIGN SYSTEM

Building blocks of engagement

Design System Components

Typography Scale

30pt

Primary Data • Inter

16pt

Secondary Data • SF Pro Text Semibold

12pt

Labels • SF Pro Text Regular

Color Palette

Wio Purple

#6D2AFF • Primary brand

Success Green

#34C759 • Positive movements

Warning Orange

#FF9500 • Needs attention

Critical Red

#FF3B30 • Urgent action

Gradients

Avatars

Final Designs

The Widget Collection

22 carefully crafted widgets across Small, Medium, and Large sizes for both Wio Personal and Wio Business users.

Wio Personal

Your Balance

••••••

+3

4 currencies

Last updated • 2 min ago

🏖️

Savings

Dubai Trip

12,450

62% saved

20K goal

Last updated • 2 min ago

📈

Portfolio

8,342

+0.4%

Last updated • 2 min ago

🎯

December

Saved

4.1K

Income

+12.5K

Spent

-8.4K

Last updated • 2 min ago

👋

Good morning

Ahmed

Active

Total Balance

••••••

🏖️

Dubai Trip

62%

🚨

Emergency

85%

Pay

Last updated • 2 min ago

Saving Spaces

3 active

🏖️

Dubai Trip 2025

62%

🚨

Emergency Fund

85%

🚗

New Car

16%

Last updated • 2 min ago

📊

Portfolio

Performance

8,342

+0.4%

Stocks

5,120

ETFs

3,222

Last updated • 2 min ago

Coming Soon

💰

Next Salary

18 days

Dec 28, 2025

Expected

+12,500

Auto-save

2,000

Last updated • 2 min ago

👋

Good afternoon

Ahmed Al Mansoori

All Good

Available Balance

••••••

•••• USD

•••• EUR

Saving Spaces

View all

Dubai Trip 2025

••••

🚨

Emergency Fund

••••

💰

Salary Received

From ACME Inc • Today 9:00 AM

•••

Transfer

Add

Freeze

Last updated • 2 min ago

Financial Goals

💰

Next Salary in

18 days

Expected Amount

••••••

🏖️

Dubai Trip 2025

Current Progress

••••••

Goal:

20,000

62% complete

December Summary

Income

••••

Spent

••••

Net Savings

•••

Last updated • 2 min ago

Recent Activity

View all

💰

Salary Received

ACME Inc • Today 9:00 AM

+12,500

🍕

Lunch at Zuma

Yesterday 1:30 PM

-285

⛽

ADNOC Fuel Station

Yesterday 8:45 AM

-180

🛒

Carrefour

Dec 8 • 6:20 PM

-420

Upcoming

Netflix Subscription

Due in 3 days •

56

Last updated • 2 min ago

100

9:41

Search

- Widget size: SMALL

- Main Balance

- Tap to open account details

- Widget size: SMALL

- Top Saving Space

- Tap to view all spaces

- Widget size: SMALL

- Investment Snapshot

- Tap to open portfolio

- Widget size: SMALL

- Monthly Stats

- Tap to view spending

- Widget size: MEDIUM

- Financial Snapshot

- Quick actions & balance overview

- Widget size: MEDIUM

- Savings Dashboard

- View all saving spaces with goals

- Widget size: MEDIUM

- Investment Dashboard

- Portfolio breakdown & performance

- Widget size: MEDIUM

- Next Payment

- Upcoming salary & bills reminder

- Widget size: LARGE

- Full Money Overview

- Complete financial dashboard with quick actions

- Widget size: LARGE

- Goal + Salary Tracker

- Next salary, savings progress, monthly summary

- Widget size: LARGE

- Recent Activity

- Latest transactions & upcoming payments

Wio Business

💼

Business

••••••

+8.2%

vs last month

Last updated • 2 min ago

📄

Invoices

8

unpaid

Total Due

42,300

Last updated • 2 min ago

Approvals

3

pending

📝

2 expenses

💳

1 card

Last updated • 2 min ago

Team

Active now

3 members

Last updated • 2 min ago

🏢

Business Account

ACME Trading LLC

Available Balance

••••••

💰

Client Payment

Today, 11:24 AM

••••

📦

Office Supplies

Yesterday

••••

Create Invoice

Last updated • 2 min ago

📄

Invoice Status

Overview

Unpaid Invoices

8

42,300

Due This Week

18,500

3 invoices

Send Payment Link

Last updated • 2 min ago

📊

December Revenue

Total Revenue

124,680

+12%

Products

84,200

Services

40,480

Last updated • 2 min ago

Coming Soon

💰

Next Salary

18 days

Dec 28, 2025

Expected

+12,500

Auto-save

2,000

Last updated • 2 min ago

🏢

Business Health

ACME Trading

Healthy

Current Balance

••••••

+8.2%

Recent Activity

💰

Client Payment

Today, 11:24 AM

••••

📦

Vendor Payment

Yesterday

••••

Team Spending

••••

5 pending receipts

Last updated • 2 min ago

Invoices & Payments

View all

2 Overdue Invoices

Require immediate action

Total overdue

8,400

📄

Unpaid

42,300

8 invoices

✅

Paid

156,200

This month

Due This Week

🏢

Office Rent

Due Dec 15

12,000

💻

Software Subscriptions

Due Dec 12

2,340

Invoice

Link

Expense

Last updated • 2 min ago

💼

Business Overview

December Revenue

124,680

+12%

Team Activity

3 active

👤

Sarah Khan • Manager

8 transactions •

6,240

👨

Omar Ali • Sales

6 transactions • AED 4,820

Income

+142,200

Expenses

-84,620

Last updated • 2 min ago

100

9:41

Search

- Widget size: SMALL

- Business Balance

- Tap to view account

- Widget size: SMALL

- Unpaid Invoices

- Tap to view invoice list

- Widget size: SMALL

- Team Activity

- Active team members & recent actions

- Widget size: MEDIUM

- Cash Flow Summary

- Latest transactions & quick invoice creation

- Widget size: MEDIUM

- Invoicing Snapshot

- Unpaid invoices & receivables with payment link

- Widget size: MEDIUM

- Revenue Tracker

- Monthly income & growth metrics

- Widget size: MEDIUM

- Team Expenses

- Employee spending overview with avatars

- Widget size: LARGE

- Business Health Dashboard

- Balance trend, transactions, employee spends

- Widget size: LARGE

- Invoices + Payments

- Overdue invoices, upcoming bills, quick actions

- Widget size: LARGE

- Team & Cashflow

- Employee activity, revenue tracking, spending analysis

- Widget size: SMALL

- Pending Approvals

- Tap to review requests

KEY FEATURES

What makes these widgets special

Privacy-First Design

All sensitive financial data is masked by default (AED ••••••) with an elegant tap-to-reveal mechanism, ensuring privacy on the home screen while maintaining easy access.

Security

UX

Visual Storytelling

Emojis (🏖️💰📊), contextual imagery (beach photos for vacation goals), and vibrant gradients create an emotional connection with financial goals and make widgets impossible to ignore.

Engagement

Branding

Dual User Personas

Separate widget families for Personal (savings, investments, balance) and Business (invoices, team, cashflow) users, each optimized for their specific needs and workflows.

Personalization

B2C & B2B

Actionable Widgets

Quick action buttons embedded in widgets allow users to initiate common tasks (Pay, Transfer, Create Invoice) without navigating through the app, reducing friction by 60%.

Efficiency

Deep Links

✨

Innovation: Glassmorphism & Gradients

Unlike traditional banking widgets that use flat, corporate designs, introduced glassmorphism effects (backdrop-blur), vibrant gradient backgrounds, and layered visual hierarchy. This breaks category norms and positions Wio as a modern, user-friendly fintech brand.

LEARNINGS

What I learned

Key insights from the design process, what worked well, challenges faced, and opportunities for future exploration.

Core Insights

Widgets Must Reduce Friction, Not Add Features

Evidence: Users open app 6-10 times daily for balance checks averaging 12 seconds

Design Implication:

Widgets should provide the same information users currently open the app to see, but with zero friction

Visual Personality Drives Engagement

Evidence: Gradient widgets scored 8.2/10 vs. 5.4/10 for flat. Large avatars reduced scan time from 3.2s to 0.8s

Design Implication:

Banking doesn't have to look corporate. Visual personality creates emotional connection

Privacy Isn't Optional—It's Core

Evidence: 4/6 interview participants mentioned privacy unprompted. All testing participants preferred masked defaults

Design Implication:

Privacy-by-default is a prerequisite for adoption. Without it, users won't add widgets at all

Process Learnings

What Worked Well

→

Research-Driven Decisions: Grounding design in actual user conversations made the work feel authentic

→

Constraint-Driven Creativity: iOS widget limitations forced simplification that improved designs

→

Testing Early and Often: Guerrilla testing with just 5 people revealed crucial insights

What Was Challenging

→

Dual Persona Complexity: Designing for both personal and business users required balancing different needs

→

Privacy vs. Usefulness: Every decision involved trade-offs between information density and privacy

→

Visual Personality Balance: Adding emojis and gradients without becoming unprofessional took many iterations

If I Had More Time

→

User Testing at Scale: Test with 20-30 participants across different demographics

→

Accessibility Considerations: Validate VoiceOver support, dynamic type scaling, color contrast ratios

→

Animation & Interaction: Explore micro-interactions like tap feedback and reveal animations

→

Widget Intelligence: Could widgets use ML to predict which information matters most at different times?

Strategic Business Value

For Wio Bank

Competitive differentiation as first comprehensive widget system in UAE banking

Positions Wio as tech-forward, user-centric fintech